More Americans are missing mortgage payments, though still fewer than pre-pandemic

Netspend analyzed Federal Reserve Bank of New York data on home mortgages to show how Americans are increasingly falling behind on payments.

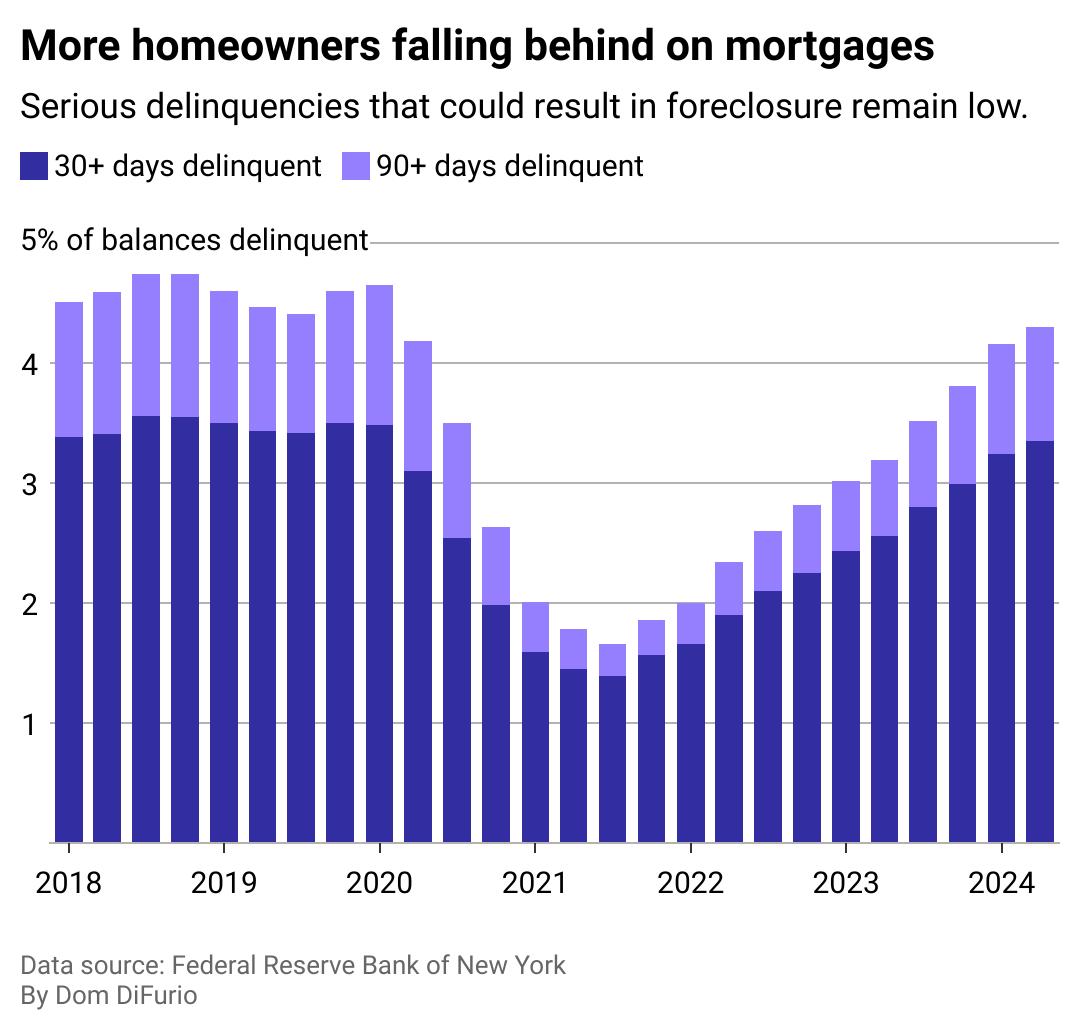

The number of Americans falling behind on their mortgage payments has risen in recent months, nearly climbing to rates last seen before the COVID-19 pandemic.

Netspend analyzed data from the Federal Reserve Bank of New York to show the uptick in homeowners falling behind on their mortgage payments since 2021.

Since lows recorded in 2021, the number of homeowners falling behind on mortgage payments has risen, as evidenced by the increasing percentage of overall balances that are delinquent each year in data tracked by the Federal Reserve Bank of New York.

Homeowners who have fallen a month or more behind on their payments are considered delinquent. Though rates are rising for delinquencies of one month or more, they haven't increased significantly in the three-month or longer delinquency range at which lenders may begin foreclosure so they can resell the property. Still, these delinquencies can foreshadow a shifting economy. The Consumer Financial Protection Bureau views early-stage delinquencies as an indicator of the overall health of the housing market.

Homeowners who financed their home purchase with Federal Housing Administration loans, in particular, are among those falling behind at the highest rates, while Veterans Affairs loan holders saw the next highest uptick in delinquencies, according to a Mortgage Bankers Association analysis of loans.

State and federally implemented programs to provide mortgage relief to conventional loan borrowers and veterans in the wake of the pandemic have come to an end over the past year. Still, the MBA said lenders are working with homeowners to provide options other than foreclosure when they fall seriously delinquent on their mortgage payments. Meanwhile, the CFPB has proposed new rules this summer that would require lenders to pause foreclosure proceedings and work with borrowers first when they request assistance with their delinquent payments.

Mortgage payments increasingly late

In the second quarter of 2024, delinquent and seriously delinquent mortgage accounts had nearly returned to pre-pandemic levels. Despite that, the portion of homeowners at real risk of losing their homes due to the inability to make payments remains historically low.

"While delinquencies are still low by historical standards, the recent increase corresponds with a rising unemployment rate, which has historically been closely correlated with mortgage performance," MBA VP of Industry Analysis Marina Walsh said in an August statement.

In the wake of the 2007-2010 housing market crash and the spike in unemployment that followed, millions of Americans lost their homes. Mortgages in serious threat of foreclosure peaked at nearly 9% of all balances, according to Fed data. Today, seriously delinquent balances sit at just below 1%, a share that's hardly changed since their historic low point seen in the depths of the COVID-19 pandemic thanks to temporary mortgage forbearance and homeowner support programs.

For now, home foreclosures remain historically low. In the second quarter of 2024, 47,000 people had new home foreclosures on their credit reports, down considerably from the 75,000 people with a recent foreclosure in the second quarter of 2018, according to Fed data.

The nationwide unemployment rate surpassed 4% this summer, worrying economists who are watching to see if Federal Reserve officials can cool off inflation with higher interest rates while avoiding a recession. If unemployment continues to rise as the Fed pushes rates higher, it could cause pain for homeowners who feel a tighter financial squeeze.

For now, homeowners are proving resilient, in part because many have locked in relatively affordable monthly payments. In 2023, around 80% of homeowners had a mortgage with an interest rate below 5%, and nearly 60% had a rate below 4%, according to Redfin.

Story editing by Alizah Salario. Additional editing by Kelly Glass. Copy editing by Tim Bruns.

This story originally appeared on Netspend and was produced and distributed in partnership with Stacker Studio.